Build trust in every transaction with data-driven insights

Elevate banking and insurance services by creating seamless, secure user experiences that foster trust and drive retention.

200%

Increase in conversions for Everpaw, a subsidiary of Pinnacle Pet Group

80%

Reduction in ticket resolution time for Finicity

20%

Increase in application form conversions for Jacaranda Finance

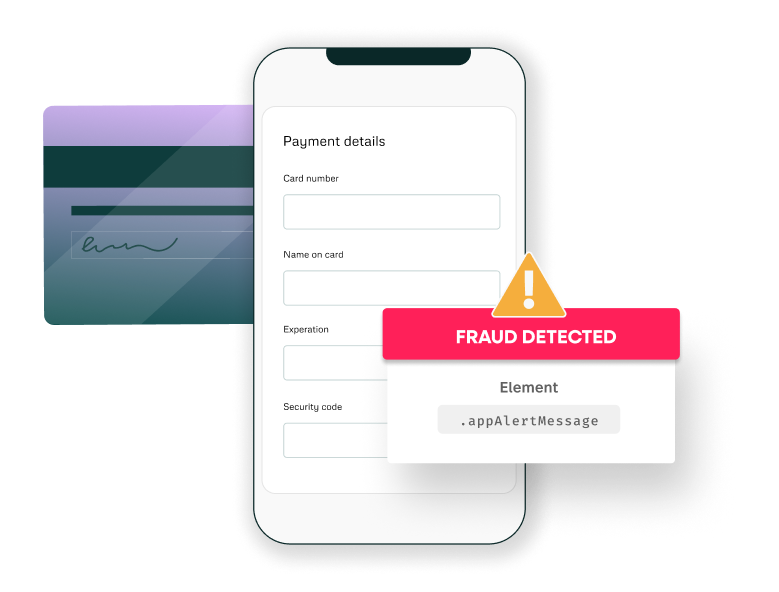

Detect fraudulent activity

Leverage real-time analytics and session replay to help banking and insurance providers quickly identify and neutralize fraud, safeguarding both sensitive customer data and company revenue.

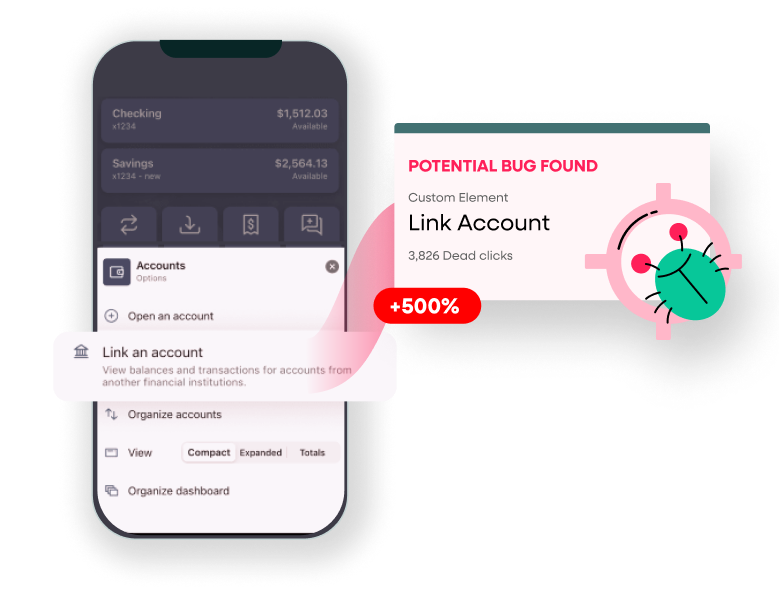

Mitigate bugs

Troubleshoot bugs in real-time to resolve issues faster and avoid abandoned carts, directly impacting revenue and engineering time.

See how Finicity resolved critical bugs faster with Fullstory →

Maximize expansion opportunities

Scale your business without compromising on customer experience. Use behavioral insights and key metrics to quickly adapt, fix errors, and meet the evolving needs of both new and loyal customers.

See how Pinnacle Pet Group maintained seamless customer journeys amidst rapid growth →

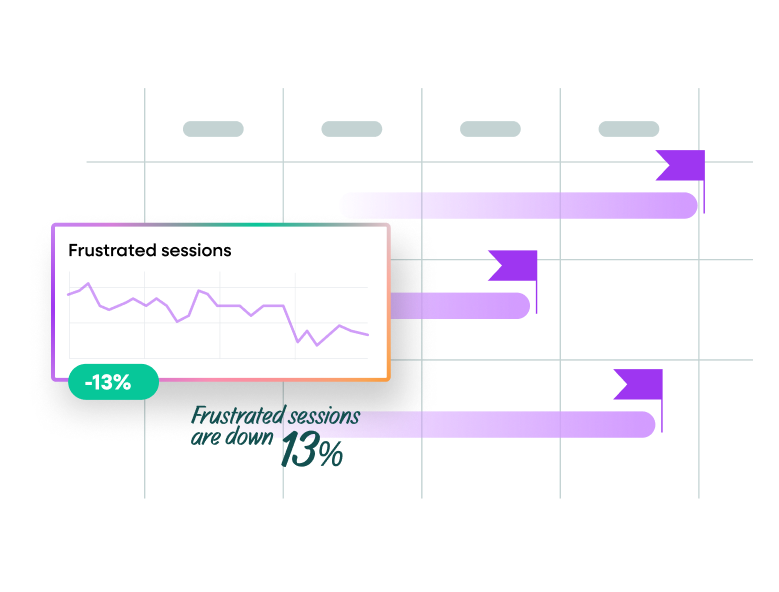

Grow revenue

Leverage Fullstory’s session replay to pinpoint and remove friction in the user journeys, reduce session abandonment, and strengthen brand trust for higher ROI.

Drive engagement

Boost satisfaction and engagement with optimized site and app experiences powered by data-driven insights from Fullstory.

Build loyalty

Trust is key for customers seeking insurance or banking solutions. Use Fullstory to address critical needs in real time, fostering reliability and long-term loyalty.

“ clear, complete picture.”

“...Fullstory goes from very macro-level analyses all the way down to individual interactions, so you can get a clear, complete picture.”

“ it’s paying dividends”

“Fullstory enables us to identify those small things that will have an outsized impact on our KPIs. We’re using these insights to make every improvement we can, and it’s paying dividends… "

Additional resources

See how this banking platform improves fraud detection process and data collection best practices.

How this Australia-based online loan service, improves the user experience, from application to customer support.

Learn how this software development company prioritizes privacy, resolves bugs, and decreases time-to-value.

Real-world examples of how a Digital Experience Intelligence solution can support your organization’s fraud prevention practices.

Get a competitive edge when you leverage behavioral data.

Learn how Fullstory’s mobile app analytics helps teams deliver seamless, personalized experiences in retail, travel, finance, and more.