The odds are that if you’re reading this, you’re part of an online retailer team facing chargeback credit card fraud, and it's becoming more than just a nuisance.

It may not even be part of your core job description, but nevertheless, here we are. Let’s cover the what and why of this type of scam and then dive in on exactly how Fullstory can make a difference.

What is chargeback fraud?

For the most part, chargeback fraud is a crime of opportunity where a consumer looking to get a product or service for free submits a fraudulent less-than-truthful chargeback request with their banking institution. The bank then reimburses the consumer for the purchase and places the burden squarely on the shoulders of the online merchant to prove the validity of the purchase. And they don’t make it easy.

Why is this a problem?

Initially, banking institutions needed to develop a way to protect consumers from shady online merchants and instill purchasing confidence. Banks allow consumers to request a chargeback against the merchant if the product they ordered online wasn’t as described, damaged, didn’t arrive, or ordered by mistake. There are many reasons why a person could call their bank or credit card company and ask for their money back.

What makes this a crime of opportunity is that, today, a growing number of consumers are scamming the system by making frivolous chargeback claims in the hopes that they will keep the product they purchased and get their money back. This puts the merchants on their heels with little wiggle room to fight back. Fighting a chargeback claim is often more costly to the merchant than allowing the consumer to get a free product leaving online retailers with a “that’s just the cost of doing business” mentality. This is called friendly fraud, the number one type of chargeback scam that merchants face today.

But wait, that’s not all! Not only is the merchant now out of revenue and inventory, but there’s a whole laundry list of other fees, penalties, and consequences the merchant faces as a result. In fact, according to Mastercard, it's estimated that merchants “incur $15 to $70 in operational costs for every card dispute.” Not to mention the ding against the merchant's risk profile from credit card payment providers like Visa and Mastercard. Not a great outcome.

How can Fullstory help?

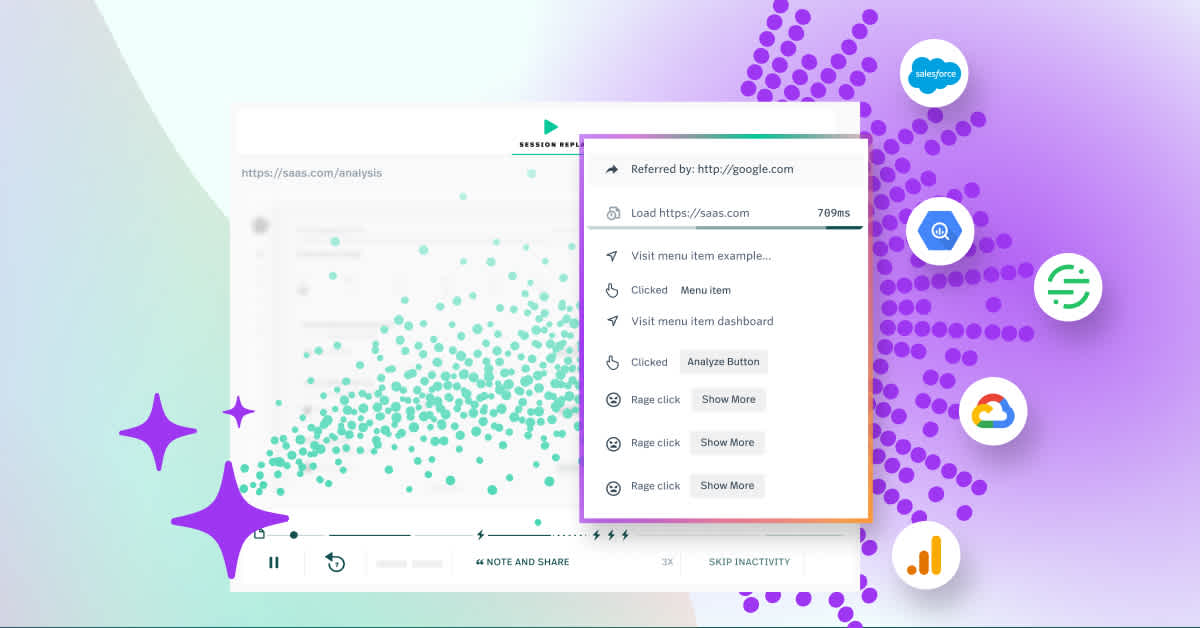

Fullstory captures every interaction users take within your site and notates that event. From those notations, we can recreate the series of events into a picture-perfect session replay. These events are also searchable at scale, so you can visualize your data within Fullstory to uncover insights and trends.

Immediate relief from chargeback fraud

For teams that are just getting to grips with fighting “friendly” fraud, here’s how Fullstory can quickly and easily provide the evidence that banks are looking for.

Type in a Transaction ID for the product or service purchased (or any other key identifier for the transaction), snap a screenshot of the session replay at the point when the user completes the purchase (or, depending on the chargeback code, provide relevant evidence like product description or the user clicking on the Terms and Conditions box), and then send it to your bank.

It's that easy! Many of our customers, such as Brightline Trains and Goldbelly Foods, have successfully used Fullstory in this way to streamline the process and achieve swift resolutions.

Long-term solutions

For teams that are ready to take on fraud in a more proactive approach, there’s good news! Fullstory customers can now have all the incredibly detailed behavioral event data synced directly to their warehouse using Data Direct. What does this mean exactly, and why should we care? Well, for one, it means your data engineering team doesn't need to spend hours transforming the data into a usable format. Fullstory delivers data in a ready-to-go JSON format alongside DBT templates to help get you started accessing the data synced every hour.

OK, cool, but what can we DO with that data?

Well, the answer here is seemingly endless possibilities. Perhaps you’re working on generating predictive score modeling to know which users accessing your site have a high-purchase intent or which users act in ways that indicate fraudulent behavior. Even if you don’t know exactly who the user is, you may know things about them, like if they stayed on that blog page for more than 5 minutes and scrolled to the bottom (maybe part of a “Reader” behavioral group, for example). Or perhaps a user conducted multiple searches while on your site; we could categorize this user as a “Searcher.” Knowing user behavioral data could then unlock new ways to curate their experience.

What if we could update their experiences dynamically in real time?

Let’s look back at our original topic (but not limited to!). What if we have a user on our site indicating behavioral patterns associated with fraudulent behavior? What if we could trigger an additional security check to help confirm if this is a bad actor or a legitimate customer without adopting a “blanket” approach? The same could be said for customers showing high purchase intent but deviating from the checkout flow; perhaps we could tease a coupon code just enough to entice the user to return and complete the checkout flow.

Leveraging our API, we can get this information in real time! This means that your team can trigger and automate custom experiences at scale!

Key takeaway

Behavioral data adds a critical layer of insight to your existing customer knowledge. It captures the nuances of customer actions and interactions on your platform. By understanding these behaviors, your team can craft highly personalized experiences that reduce friction and ensure a superior digital journey. This deep understanding of customer behavior is critical to maintaining happiness and loyalty among your users, ultimately delivering an outstanding digital experience.